Cryptocurrency trading has become a popular avenue for investors seeking high returns. However, the volatile nature of the market requires a well-thought-out strategy to navigate successfully. This article will explore various crypto trading strategies, providing insights and tips to help you maximize your profits and minimize risks.

Introduction to Crypto Trading

Cryptocurrency trading involves buying and selling digital assets like Bitcoin, Ethereum, and other altcoins to earn a profit. Unlike traditional markets, the crypto market operates 24/7, offering continuous trading opportunities. However, this also means that traders need to be vigilant and well-prepared to handle market fluctuations.

Understanding Market Analysis

Before diving into specific strategies, it’s essential to understand the two main types of market analysis:

- Technical Analysis (TA): This involves analyzing historical price data and trading volumes to predict future price movements. Traders use various tools and indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to identify trends and make informed decisions.

- Fundamental Analysis (FA): This approach evaluates the intrinsic value of a cryptocurrency by examining factors like the project’s technology, team, market demand, and overall market conditions. Fundamental analysis helps traders understand the long-term potential of an asset.

Popular Crypto Trading Strategies

- Day Trading

Day trading involves buying and selling cryptocurrencies within the same day to capitalize on short-term price movements. This strategy requires a deep understanding of technical analysis and the ability to make quick decisions. Day traders often use leverage to amplify their gains, but this also increases the risk.

- Swing Trading

Swing trading aims to capture gains for days or weeks. Traders look for “swings” in the market, where the price moves significantly in one direction. This strategy combines technical and fundamental analysis to identify potential entry and exit points.

- Scalping

Scalping is a high-frequency trading strategy that involves making numerous small daily trades to profit from minor price changes. To execute trades quickly, scalpers need to be highly disciplined and have access to advanced trading tools and platforms.

- HODLing

HODLing, derived from a misspelling of “hold,” is a long-term investment strategy where traders buy and hold cryptocurrencies for an extended period, regardless of market volatility. This strategy is based on the belief that the value of cryptocurrencies will increase over time.

- Arbitrage

Arbitrage involves buying a cryptocurrency on one exchange where the price is lower and selling it on another exchange where the price is higher. This strategy exploits price discrepancies between different exchanges. While arbitrage can be profitable, it requires quick execution and awareness of transaction fees.

- Dollar-cost averaging (DCA)

DCA is a strategy where traders invest a fixed amount of money into a cryptocurrency at regular intervals, regardless of its price. This approach reduces the impact of volatility and lowers the average cost of investment over time.

Risk Management

Effective risk management is crucial for successful crypto trading. Here are some key practices:

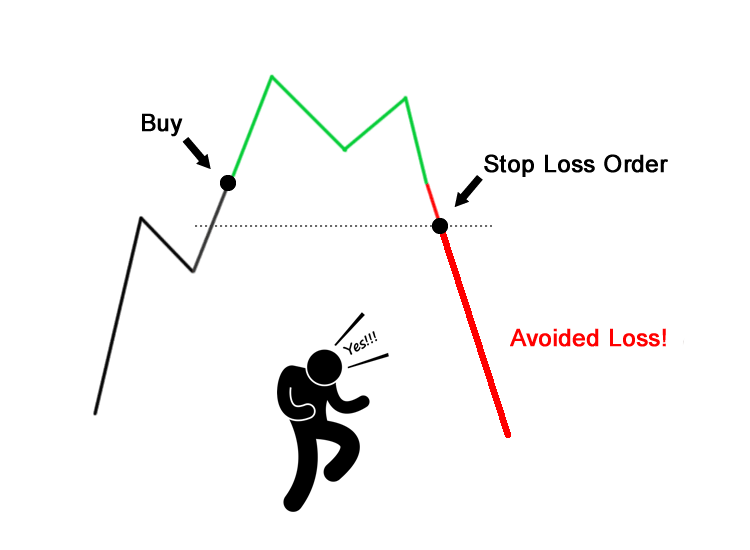

- Set Stop-Loss Orders: A stop-loss order automatically sells a cryptocurrency when its price falls to a predetermined level, limiting potential losses.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies to reduce risk. Diversification helps mitigate the impact of a poor-performing asset on your overall portfolio.

- Use Leverage Cautiously: While leverage can amplify gains, it also increases the risk of significant losses. Use leverage sparingly and only when you have a clear understanding of the market.

- Stay Informed: Keep up with the latest news and developments in the crypto market. Market sentiment can change rapidly, and staying informed helps you make better trading decisions.

Tools and Resources

To implement these strategies effectively, traders need access to various tools and resources:

- Trading Platforms: Choose a reliable trading platform that offers advanced charting tools, real-time data, and low transaction fees. Popular platforms include Binance, Coinbase Pro, and Kraken.

- Technical Analysis Tools: Utilize tools like TradingView for comprehensive charting and technical analysis. These tools provide a wide range of indicators and drawing tools to help you analyze the market.

- News Aggregators: Stay updated with the latest news through aggregators like CoinDesk, CoinTelegraph, and CryptoSlate. These platforms provide real-time news and analysis on the crypto market.

- Community Forums: Engage with other traders on forums like Reddit, Bitcointalk, and Telegram groups. These communities offer valuable insights, tips, and support from experienced traders.

Conclusion

Crypto trading can be highly rewarding, but it requires a solid strategy and disciplined approach. By understanding different trading strategies, managing risks effectively, and staying informed, you can navigate the volatile crypto market and achieve your trading goals. Remember, continuous learning and adaptation are key to long-term success in the ever-evolving world of cryptocurrency trading.

Visit More: alshakirstore.com